Facing a divorce is tough enough without worrying about how you'll make ends meet afterward.

In Texas, post-divorce support is legally called spousal maintenance, and it’s not granted automatically. Unlike some other states, Texas has very specific, strict rules you have to meet before a judge will even consider it. The law is designed to be a temporary safety net, not a permanent solution, and you must prove you are eligible.

Let's walk through exactly what you need to do to qualify for support and build a strong case.

Understanding Your Eligibility for Spousal Support in Texas

Think of qualifying for spousal maintenance like getting through a locked door. First, you must prove to the court that you'll lack enough property after the divorce—including your separate property—to provide for your minimum reasonable needs. This is the initial threshold you have to cross.

Once you've established that need, you have to find the right key to unlock the door. Under the Texas Family Code § 8.051, there are two main "keys" that can open the door to a spousal maintenance award.

The 10-Year Marriage Rule

This is the most common path to eligibility. If you were married for 10 years or longer, you might qualify for spousal maintenance. However, the length of your marriage is just the first part of the equation.

You also have to show the court that you've made a real effort to earn a living or get the skills you need to support yourself, but you still can't cover your basic needs. A judge will want to see that you’re actively trying to find a job or get training. The law essentially presumes you don't need support unless you can prove otherwise through clear evidence.

The Family Violence Exception

The second path is an important exception that does not depend on how long you were married. You may qualify for support if your spouse was convicted of (or received deferred adjudication for) a criminal act of family violence.

This is a critical protection for survivors of domestic abuse. To qualify under this rule, the act of violence must have been committed against you or your child and occurred either:

- Within two years before the divorce was filed, or

- While the divorce case was ongoing.

This rule recognizes that leaving an abusive situation often comes with immense financial and emotional challenges, providing a way to secure the financial help you need to move forward safely.

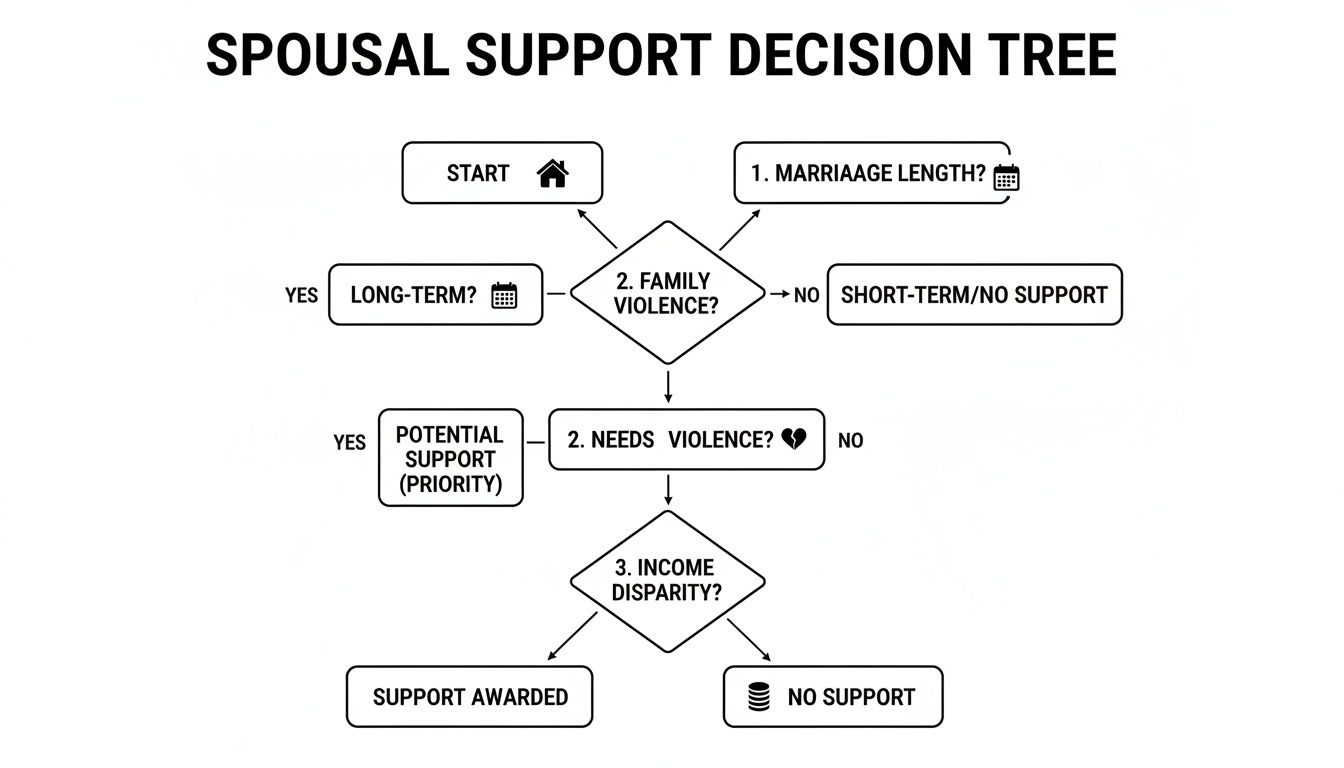

Navigating these rules can be confusing, so this decision tree breaks down the two main questions a Texas court will ask first.

As you can see, getting your foot in the door for spousal maintenance in Texas really comes down to either how long you were married or whether family violence was a factor.

Meeting one of these initial tests doesn't guarantee you'll receive payments, but it opens the door for a judge to consider your request. From there, the court will look at many other factors to decide if you should get support, how much, and for how long. To get the full picture, you can explore our complete guide on how spousal maintenance works in Texas.

Two Paths to Qualify for Spousal Maintenance in Texas

This table breaks down the two primary ways you can meet the initial requirements for post-divorce spousal maintenance under Texas law.

| Eligibility Path | Key Requirements | Best For |

|---|---|---|

| The 10-Year Marriage Rule | Married for 10 years or more; and cannot earn enough to meet minimum reasonable needs, despite diligent efforts. | Spouses in long-term marriages who have been out of the workforce, often as homemakers or primary caregivers. |

| The Family Violence Exception | Spouse was convicted of or received deferred adjudication for an act of family violence against you or your child within 2 years of filing or during the divorce. | Survivors of domestic abuse who need financial support to safely leave the marriage, regardless of its length. |

Remember, these are just the starting points. A Texas court will dig much deeper into your family's specific circumstances before making a final decision.

The 11 Factors a Texas Judge Must Consider

Just meeting the starting-line requirements—like the 10-year marriage rule—doesn't mean a judge will automatically award spousal maintenance. A judge's decision isn’t based on a simple formula; it's a deeply human process that weighs the entire story of your marriage to achieve a fair and just result.

Under Texas Family Code § 8.052, a judge is required to look at 11 specific factors before deciding on the amount, duration, and nature of spousal support. This is where your personal circumstances truly come into focus.

Financial Standing and Earning Ability

First, the judge examines the financial reality each of you will face once the divorce is final. They're looking at your ability to provide for your own minimum reasonable needs independently.

This involves a careful comparison of both spouses' financial resources. The court will consider:

- Each spouse's ability to provide for their own needs: This means analyzing your current and future earning potential, your education, and your specific job skills.

- The education and employment skills of both spouses: The judge will think about how long it might realistically take for you to get the training or education needed to stand on your own two feet.

- The property brought to the marriage by each spouse: Any separate property you or your spouse owns can absolutely influence the judge's decision.

For example, if you have a college degree but have been out of the workforce for 15 years raising children, the court will weigh that reality against your spouse’s established career and six-figure income.

Contributions and Conduct During the Marriage

Next, the court looks beyond the bank statements to the roles each of you played during the marriage and how you both behaved. This is where fairness and personal history come into play.

A judge will evaluate things like:

- The age, employment history, and physical and emotional condition of the spouse seeking support: A spouse in their late 50s with chronic health issues will be viewed very differently than a healthy 35-year-old.

- Each spouse's contributions as a homemaker: Texas law explicitly recognizes the value of a stay-at-home parent. Your years spent managing the household, raising children, and supporting your spouse’s career are a significant factor.

- Any marital misconduct: This includes things like adultery or cruel treatment by either spouse during the marriage. Hard evidence of wasting community funds—like spending thousands of dollars on an affair—can directly impact a judge’s ruling.

Other Relevant Considerations

Finally, the court has the flexibility to consider any other factors needed to reach a "just and right" outcome. This catch-all category can include powerful circumstances.

- Acts of family violence: A documented history of abuse is a significant factor.

- Contributions by one spouse to the other's education or career: If you worked two jobs to put your spouse through medical school, for instance, that sacrifice will be considered.

- Any patterns of concealing or defrauding the community estate.

These factors aren't a simple checklist where one item outweighs all the others. Instead, a judge carefully balances them to arrive at a fair decision tailored to your family’s unique story. You can learn more about the intricate details of these considerations in our overview of Texas spousal support factors, duration, and modification.

Calculating Spousal Support Amount and Duration

Once you’ve confirmed you might qualify for spousal maintenance, the next two questions are always the same: "How much money will I get?" and "How long will it last?" The thought of building a new life on an unknown income is incredibly stressful, but Texas law provides a clear, though limited, framework for the answers.

A judge can’t just pull a number out of thin air. They are bound by specific statutory caps designed to prevent excessive or unpredictable awards. Understanding this framework helps you form a realistic financial picture, so you can plan your next steps with more confidence.

The Texas Formula for Payment Amounts

Texas law puts a hard ceiling on how much spousal maintenance a court can order. A judge’s award cannot exceed the lesser of two key figures: $5,000 per month or 20% of the paying spouse's average monthly gross income.

Think of it as a two-part test. First, the court calculates 20% of the paying spouse’s gross income. If that number is, say, $4,000, then $4,000 is the maximum monthly payment allowed. But if that calculation comes out to $8,000, the award is capped at the $5,000 statutory limit instead.

To figure out the "average monthly gross income," a court looks at everything—not just a base salary. The calculation includes:

- Wages, salary, bonuses, and commissions

- Income from a business for self-employed individuals

- Rental income from investment properties

- Interest and dividends from investments

This comprehensive approach ensures the final number reflects the paying spouse's total financial capacity. For a more detailed breakdown of the numbers, check out our guide on how much spousal support is in Texas.

How Marriage Length Determines Payment Duration

Just like the payment amount is capped, so is the length of time you can receive support. The goal of spousal maintenance in Texas is rehabilitative—it’s meant to be a temporary bridge while you get back on your feet financially. Because of this, the duration is tied directly to how long you were married.

Texas Family Code § 8.054 sets strict limits on how long a court can order spousal maintenance payments. This ensures that support is a temporary bridge to self-sufficiency, not a lifelong obligation, except in very specific circumstances.

The law sets clear maximum timelines for how long support can last.

Texas Spousal Maintenance Duration Limits

Here's a quick reference guide to the maximum duration a judge can order based on the length of your marriage. Remember, a judge can always order a shorter duration, but not a longer one, unless a rare exception applies.

| Length of Marriage | Maximum Duration of Support | Texas Family Code Section |

|---|---|---|

| 10 to 20 years | Up to 5 years | § 8.054(a)(1)(A) |

| 20 to 30 years | Up to 7 years | § 8.054(a)(1)(B) |

| Over 30 years | Up to 10 years | § 8.054(a)(1)(C) |

These timeframes are the absolute maximums a court can order. A judge has the discretion to award support for a shorter period based on the specific facts of your case, like how long it might reasonably take you to find a job or complete a training program.

Are There Exceptions to These Duration Limits?

Yes, but they are very specific and quite rare. Texas law makes an exception for indefinite spousal maintenance—meaning it can continue for as long as the underlying condition exists—in two key situations:

- Disabling Condition: If you have an incapacitating physical or mental disability that prevents you from earning enough to support yourself.

- Caring for a Disabled Child: If you are caring for a child of the marriage who has a substantial physical or mental disability requiring so much supervision that it prevents you from working.

In these exceptional cases, the law recognizes that becoming self-sufficient might not be a realistic possibility, and a longer-term financial safety net may be necessary.

How to Build Your Case for Spousal Support

Believing you qualify for spousal support is one thing, but proving it to a Texas court is another. The financial uncertainty that comes with divorce can feel overwhelming, but you can take back control by methodically building a strong, evidence-based case. This isn't just about asking for help; it's about showing your need with clear, undeniable proof.

To get a judge to award support, you have to prove that even after your marital property is divided, you will still lack enough assets to provide for your "minimum reasonable needs." This is a specific legal standard, and the only way to meet it is with meticulous documentation. Your personal story must be supported by a financial picture so clear it leaves no room for doubt.

Gathering Your Essential Financial Documents

First, you need to collect every piece of paper that tells the story of your financial life. This evidence is the bedrock of your argument, showing the court exactly what you have, what you earn, and what it costs for you to live.

Your evidence checklist should include:

- Income and Tax Records: Pull together at least two years of tax returns, your most recent pay stubs, and any W-2 or 1099 forms for both you and your spouse.

- Bank Statements: Collect statements from the last year for all checking, savings, and investment accounts. This shows your available cash and spending habits.

- A Detailed Monthly Budget: This is crucial. Create a comprehensive list of all your anticipated monthly expenses—from the mortgage or rent payment down to groceries, gas, utilities, and healthcare costs. This document is your proof of "minimum reasonable needs."

- Proof of Assets and Debts: Compile statements for any retirement accounts, mortgages, car loans, and credit card debt. This helps paint a complete picture of the net resources available to you post-divorce.

Proving Your Efforts and Earning Capacity

A Texas court won't just look at your needs; it also requires you to show that you are making a diligent effort to become self-sufficient. This means you have to be actively looking for a job or getting the training you need to secure one. Simply telling the judge you can't find work isn't enough.

You must document your job search as if it were a job itself. Keep a detailed log of every application you submit, every interview you attend, and every networking event you go to. This creates a powerful record of your good-faith efforts.

In some situations, particularly if you’ve been out of the workforce for a long time, the testimony of a vocational expert can be a game-changer. This professional can assess your skills, analyze the current job market, and give an expert opinion on your realistic earning potential and how long it might take you to get there.

The dynamics of who qualifies for support are influenced by many factors, including custody arrangements and the income gap between spouses. For context, international data shows that where shared custody is more common, reliance on alimony tends to be lower. In Texas, a similar need-based system is in place; 2025 data from Harris County suggests that about 22% of custodial parents in marriages lasting over 10 years may qualify if the income disparity is significant. Building a strong case with solid evidence is your key to meeting these strict Texas standards. You can explore more about these global alimony dynamics and their influencing factors.

Navigating Complex Divorce Scenarios

Not all divorces fit into a neat box. When your life involves significant assets, military service, or a family business, figuring out spousal support can feel even more overwhelming. Each of these situations adds another layer of complexity to the question of what’s fair and how you can qualify for the support you need.

Let’s break down these specific scenarios with some clear, practical advice.

Spousal Support in High-Net-Worth Divorces

When your divorce involves a high-value estate, the term "minimum reasonable needs" takes on a whole new meaning. A Texas court won't just look at what you need to cover basic bills; it will consider the marital lifestyle you and your spouse built together. The goal isn’t merely survival—it’s to prevent the lower-earning spouse from suffering an extreme and unfair plunge in their standard of living.

For business owners and individuals with high-value estates, proving your case requires a sophisticated strategy. You'll need to:

- Document the Marital Lifestyle: Gather evidence that paints a clear picture of your standard of living. Think travel records, credit card statements showing luxury purchases, and documents related to high-value property like vacation homes or country club memberships.

- Value Complex Assets: This is where you bring in the experts. Forensic accountants are often needed to accurately value business interests, stock options, trusts, and other complicated investments.

- Connect Assets to Needs: Your legal team’s job is to clearly show the judge how these assets and your established lifestyle directly influence what is "reasonable" for your financial needs moving forward.

Guidance for Military Families

Divorce for military families means navigating both Texas family law and federal regulations, which creates a unique set of rules. The key piece of federal law is the Uniformed Services Former Spouses' Protection Act (USFSPA). This act allows Texas courts to treat disposable military retired pay as community property, meaning it can be divided in your divorce.

This is a critical point. If a portion of that retirement pay is awarded to you as part of the property division, a court will count it as a resource you have to meet your own needs. This, in turn, could impact your eligibility for spousal maintenance. A court will also look at other military benefits, like BAH and BAS, as part of the service member’s gross income when running the numbers for potential support payments.

Support When a Spouse Owns a Business

What happens when your spouse’s income doesn’t come from a straightforward W-2? For spouses of business owners, proving the true income available for support is often the single biggest hurdle. The owner usually has significant control over their stated salary, and it's not uncommon for business expenses to be used to mask personal spending.

When a business is involved, just looking at tax returns isn’t nearly enough. You need a legal team that knows how to dig deeper and uncover the real financial picture. This often means working with financial experts to analyze business records and identify the actual cash flow available to the family.

To build a strong case, you may need to launch a full financial investigation. This could involve subpoenaing bank records, deposing the business's accountant, or even hiring a forensic expert to perform a complete business valuation. This is the only way to ensure that any spousal support calculation is based on reality, not just what's reported on paper.

A Few Common Questions About Spousal Support

Going through a divorce stirs up a whirlwind of questions, especially when it comes to your financial future. Getting straight answers is the first step toward feeling in control. Here are some of the most frequent questions we hear from clients about spousal support in Texas, answered simply to help you see things more clearly.

Can I Get Spousal Support If I Committed Adultery?

This is one of the most common—and stressful—questions people ask. The honest answer is: it’s complicated. While adultery doesn't automatically slam the door on receiving spousal maintenance, it's definitely a factor the judge will look at under the broad category of "marital misconduct."

If your spouse can prove you were unfaithful, the judge has to weigh that fact against everything else—the length of your marriage, your proven financial need, your contributions as a homemaker, and so on. Adultery can certainly hurt your case, possibly reducing the amount or how long you receive support, but it isn't an absolute deal-breaker if your need for assistance is clear and well-documented.

What Is the Difference Between Spousal Maintenance and Contractual Alimony?

People often use these terms as if they mean the same thing, but in the eyes of a Texas court, they are worlds apart. It's a critical distinction to understand.

-

Spousal Maintenance is what a judge orders after a trial. It’s strictly regulated by the Texas Family Code, with firm caps on how much can be paid ($5,000 per month or 20% of the paying spouse's gross income, whichever is less) and for how long. It’s only available if you meet very specific, narrow criteria.

-

Contractual Alimony, on the other hand, is support paid because you and your spouse agreed to it, usually in mediation. Because it’s a private contract, it isn’t chained to the state’s rigid limits. You and your spouse have the freedom to negotiate any amount for any duration you both believe is fair, which makes it a much more flexible and creative tool.

Do I Have to Pay Taxes on Spousal Support Payments?

The rules on this changed completely a few years ago, and it's a big deal for anyone creating a post-divorce budget. Thanks to the federal Tax Cuts and Jobs Act of 2017, for any divorce or separation agreement finalized after December 31, 2018:

- The spouse paying support cannot deduct the payments on their taxes.

- The spouse receiving support does not have to report it as taxable income.

This was a major reversal from the old system, and it's a crucial detail to factor in when you're negotiating a settlement.

Can Spousal Support Be Modified After the Divorce Is Final?

Yes, but it's not easy. A court-ordered spousal maintenance plan can only be changed if you can prove there has been a "material and substantial change" in either person's life circumstances since the order was made.

What does that mean in the real world? It usually involves a major, unforeseen event like an involuntary job loss, a debilitating illness, or if the receiving spouse remarries or starts living with a new romantic partner. Just deciding you want to pay less or feel you need more isn't enough to get a judge to reopen the case.

What to Do Next

Knowing the law is one thing; taking decisive action to protect your future is another. The path ahead might seem daunting, but with a clear plan, you can trade uncertainty for confidence. This is your roadmap for moving forward.

The journey to securing spousal support is all about preparation. You can build the strongest possible case by focusing on these essential steps:

- Do an Honest Eligibility Check: Review the two main ways to qualify under Texas law—the 10-year marriage rule or the family violence exception. Be realistic about whether your situation fits squarely into one of these categories.

- Start Gathering Your Paperwork: Begin collecting every financial document you can get your hands on. We're talking tax returns, bank statements, pay stubs, and records for all your assets and debts. Good organization is your best friend.

- Create a Real-World Budget: List every single monthly expense you expect to have after the divorce. This is how you define your "minimum reasonable needs" and turn a vague request into a hard, provable number for the court.

The divorce process is a marathon, not a sprint, and you don't have to run it alone. The single most important move you can make is to get skilled legal advice early on. It’s the key to protecting your rights and giving yourself the best shot at a stable financial future.

Your future stability is too important to leave up to chance. At The Law Office of Bryan Fagan, PLLC, we’re here to give you the compassionate guidance and strong representation you need. We invite you to schedule a free, no-obligation consultation with one of our experienced attorneys. Let's talk through your situation and start building a personalized strategy to secure the financial footing you need to start your next chapter with confidence.