Watching your retirement savings get caught in the crossfire of a divorce can be terrifying. You’ve spent years building that nest egg, and the thought of it being sliced in half is a tough pill to swallow. But in Texas, dividing a 401k in divorce doesn't automatically mean you lose half of everything you've ever saved. The law draws a clear line between what you earned before your marriage and what you built together during it, and understanding this difference is the first step toward protecting your future.

How Texas Law Views Your 401k in a Divorce

When you’re going through a divorce, your 401k is often one of the largest financial assets on the table. You've likely spent a significant part of your career contributing to it, viewing it as the foundation of your future security. The idea of splitting it can feel like a devastating setback. Fortunately, understanding how Texas law actually handles this asset can provide much-needed clarity and a sense of control.

The most important concept you need to grasp is that Texas is a community property state. This isn't just legal jargon; it's a framework outlined in the Texas Family Code designed to ensure a fair division of everything acquired during the marriage, and it directly governs how your 401k is treated.

Community Property vs. Separate Property

In a Texas divorce, every asset you and your spouse own gets sorted into one of two buckets:

- Separate Property: This is what was yours before you got married. For your 401k, the account balance on your wedding day is typically considered your separate property. This category also includes any gifts or inheritances you alone received during the marriage.

- Community Property: This is the legal term for all assets either you or your spouse acquired during the marriage. This is the portion of your 401k that is on the table for division.

So, the entire value of your 401k isn't up for grabs. Only the community property portion—the value built during your marriage—will be divided. That includes your contributions, your employer's matching funds, and any investment gains or losses on those contributions that occurred between your wedding day and the day your divorce is finalized.

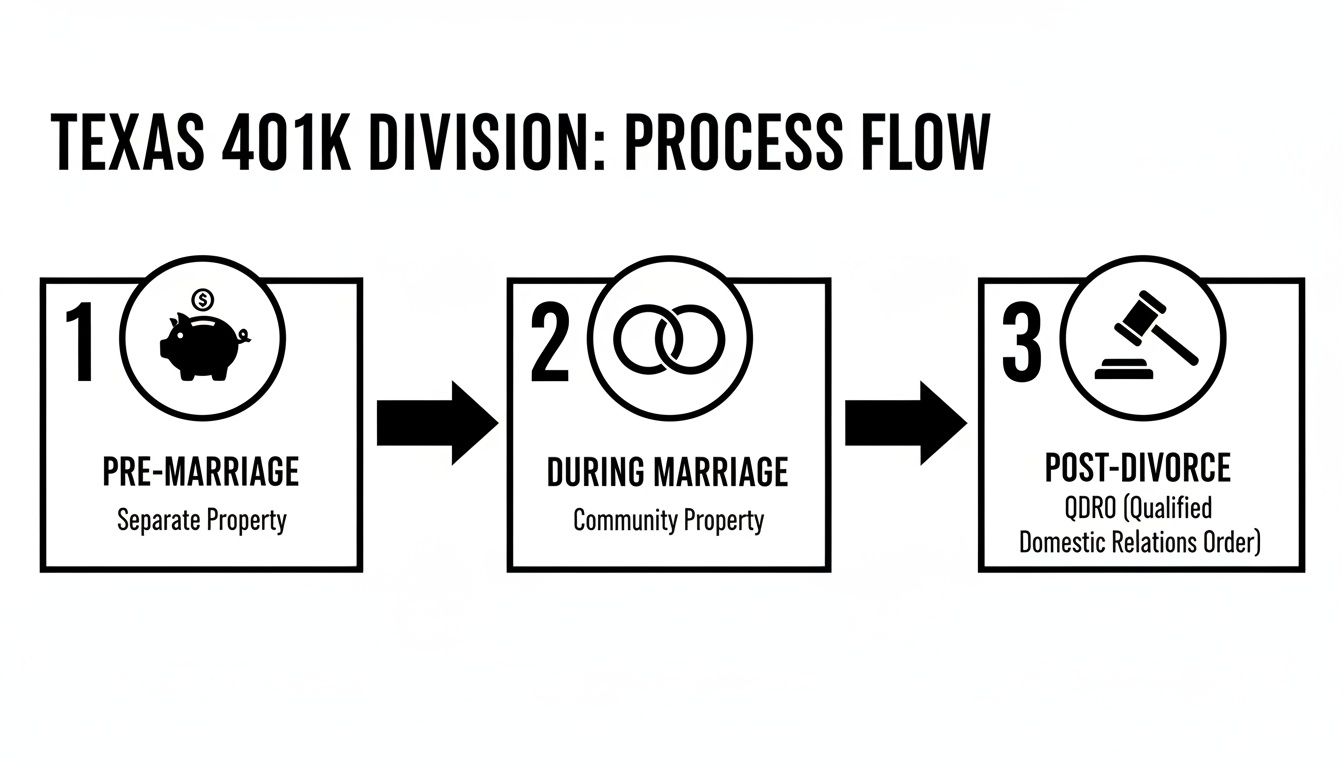

To help you visualize how this works, here’s a step-by-step breakdown of how the different parts of your 401k are typically classified in a Texas divorce.

Your Texas 401k at a Glance: What Is Separate vs. Community Property?

| 401k Component | Typical Classification | Why It Matters |

|---|---|---|

| Pre-Marriage Balance | Separate Property | This is the value of your account on the day you got married. It's yours alone and not subject to division. |

| Contributions During Marriage | Community Property | Any money you put into the 401k from your paycheck during the marriage belongs to the community estate. |

| Employer Match During Marriage | Community Property | Just like your contributions, any matching funds from your employer during the marriage are considered marital property. |

| Gains/Losses on Pre-Marriage Balance | Separate Property | The growth or decline of your separate property portion generally remains separate property. |

| Gains/Losses on Community Contributions | Community Property | All investment performance on the marital portion of the account is also part of the community estate to be divided. |

| Inherited Funds Rolled In | Separate Property | If you inherited money and rolled it into your 401k, it’s typically your separate property, provided you can trace it. |

This table illustrates a crucial point: you don't have to guess what's yours versus what's shared. Texas law provides a clear framework, but it's up to you to provide the evidence to prove your separate property claim.

The Presumption of Community Property

Here's where things get serious. Under the Texas Family Code, any property you or your spouse have at the time of divorce is presumed to be community property. The burden of proof is on you if you claim a portion is separate.

To protect the pre-marriage value of your 401k, you must provide "clear and convincing evidence" of what that value was. Usually, this means digging up account statements from around the time of your marriage. Without that proof, a judge could treat the entire account as community property, leading to a drastically different and less favorable outcome for you. This is why good record-keeping is absolutely critical.

A common mistake is thinking, "It's my 401k, in my name, so it's my money." In Texas, the name on the account is irrelevant. It’s all about when the contributions were made. The law views marriage as a partnership, and assets built during that partnership belong to the community.

As one of the nine community property states, Texas law aims for a "just and right" division of the marital estate. More often than not, this results in a 50/50 split of the community portion of assets like a 401k. This approach ensures that all contributions to the marriage—financial or otherwise—are recognized. To learn more, check out our guide on what makes Texas a community property state. Protecting what is rightfully yours starts with understanding these rules and being prepared to back up your claims with solid proof.

Using A QDRO To Divide Your Retirement Account

If you’re going through a divorce, you’re probably hearing a lot of legal acronyms being thrown around. It can feel overwhelming, but there’s one you absolutely must know: QDRO.

This stands for Qualified Domestic Relations Order, and it is the only legal tool that can properly divide a 401k. This is not optional. Simply having your divorce decree state how the account should be split is not enough to get the job done.

Think of it from the perspective of your 401k plan administrator, like Fidelity or Vanguard. They have a strict legal duty to protect your retirement funds. They can’t just cut a check to your ex-spouse because your divorce papers say so. They need a separate, specific court order—the QDRO—that gives them explicit, legally-binding instructions on exactly how to split the account. Without it, the account remains untouched, entirely in your name.

This chart gives you a simplified visual of how a 401k is viewed at different stages of life in a Texas divorce.

As you can see, it’s the growth during the marriage that’s considered community property. The QDRO is the legal mechanism that makes the post-divorce division happen.

Why a QDRO Is Your Financial Shield

A QDRO does more than just give instructions; it provides a critical layer of financial protection for both you and your former spouse. Its most important job is to prevent a massive, immediate tax hit.

Let’s say you tried to bypass this process and just withdrew money from your 401k to pay your ex their share. The IRS would see that as a standard early distribution. That means you’d get hit with:

- Income taxes on the entire amount you took out.

- A punishing 10% early withdrawal penalty if you're under age 59 ½.

A properly drafted and executed QDRO lets you sidestep those penalties entirely. It facilitates a direct transfer of funds from your 401k to your ex-spouse, usually into a rollover IRA set up in their name. This is considered a non-taxable event, which preserves the nest egg for both of you.

The QDRO Process In Texas

Getting a QDRO isn't a single event but a multi-step process that demands precision. One small mistake in the wording can cause the plan administrator to reject the order, leading to months of delays and added legal fees.

Here's a step-by-step breakdown of how it works:

- Drafting the Order: The QDRO must be written with very specific language that satisfies both federal law (ERISA) and the unique rules of your particular 401k plan. This is absolutely not a DIY document; it requires an attorney who knows this area of law inside and out.

- Approval by All Parties: Before it goes to the judge, both you, your spouse, and your lawyers will review and sign off on the draft QDRO. This ensures it lines up perfectly with the terms of the divorce decree.

- Submission to the Judge: Once everyone has approved it, the QDRO is submitted to the family court judge for their signature, turning it into an official court order.

- Submission to the Plan Administrator: The signed order is then sent to your 401k plan administrator. They have their own internal review process to confirm the order is "qualified" and that they can follow its instructions. This review alone can take weeks or even months.

- Segregation of Funds: Once the administrator gives the final approval, they will create a separate account for your ex-spouse (now called the "alternate payee") and transfer the awarded portion of the funds.

Practical Advice: Let's say your divorce decree awards your spouse 50% of the community portion of your 401k, which works out to be $150,000. Your attorney drafts a QDRO specifying that exact percentage and transfer. After the judge signs it and the 401k plan approves it, the plan administrator moves $150,000 from your account directly into a new rollover IRA for your spouse. You pay zero taxes or penalties on that transfer, and their money is now in their name, continuing to grow tax-deferred for their own retirement.

Because this document is so fundamental to your financial future, getting it right the first time is essential. For a deeper dive into these financial complexities, read our article on surviving the financial storm of divorce and retirement in Texas.

Calculating the Community Share of Your 401k

Figuring out the exact dollar amount of the marital portion of your 401k is more complicated than it looks. It’s almost never as simple as subtracting the account balance on your wedding day from what it’s worth today.

That simple math completely ignores the growth on your pre-marriage funds—the investment gains, dividends, and interest that are also your separate property. Getting this calculation right is one of the most critical steps to a fair property division. A mistake here can cost you tens, or even hundreds, of thousands of dollars from your future retirement.

Tracing Your Separate Property

The key to protecting the money you brought into the marriage is a process called tracing. Think of it like a financial investigation. You have to meticulously follow your separate property funds from the date of marriage all the way to the present day, accounting for all growth along the way. Your job is to prove, with clear and convincing evidence, exactly what portion of that account is yours and yours alone.

To do this, you will need specific documents:

- The 401k statement from right before your marriage. This is your starting point, establishing the initial separate property balance.

- The most current 401k statement. This shows the account's total value as of the divorce.

- All statements in between, if you can get them. These are invaluable for tracking contributions, employer matches, and investment performance over the years.

Common Calculation Methods

While every divorce has its own unique details, Texas courts often use specific formulas to untangle the community interest in a 401k. One common approach involves a formula that looks at the balance at marriage, the balance at divorce, and all the contributions made during the marriage to properly allocate investment gains between your separate funds and the community contributions.

Practical Advice: Let’s say your 401k was worth $50,000 on your wedding day and is now worth $300,000. If you contributed $100,000 during the marriage, the community share isn't just $250,000. A more complex calculation is needed to fairly allocate the investment gains that occurred on both your separate property and the community property portions. This is a far more accurate—and just—method.

This process can get incredibly messy when you factor in market crashes, changing investment funds, rollovers from old jobs, or loans taken from the account. Because these numbers are so vital, many people find it helpful to start with our resources on how to prepare for divorce financially to get a handle on the bigger picture.

When to Bring in a Financial Expert

So, what happens if you can't find that crucial statement from a decade ago? Or what if the account was rolled over from a previous employer, mixing everything together? In these situations, guessing is simply not an option. You need proof.

This is exactly when hiring a forensic accountant becomes essential. These financial professionals are specialists in tracing complex assets in divorce cases. They can dig into partial records, reconstruct account histories, and use sophisticated methods to accurately separate the community and separate property interests.

A forensic accountant can:

- Reconstruct missing account history using whatever data is available.

- Calculate the precise investment growth on your separate property portion of the account.

- Provide an expert report that can be used in mediation or presented as evidence in court.

Their report provides the unbiased, data-driven proof you need to support your claim in court. While it’s an added expense, the cost of hiring a forensic accountant is often a fraction of the separate property they can help you protect. This is especially true in long-term marriages or with high-value retirement accounts where decades of growth must be untangled. An accurate calculation is the foundation of a fair outcome.

Negotiation Strategies and Common Pitfalls to Avoid

Knowing the math behind dividing a 401k is one thing, but successfully negotiating the split is where you can truly protect your financial future. This isn't just about cutting a number down the middle. It's about smart discussions, creative solutions, and sidestepping the costly mistakes that trip up so many people. Your approach here can have a massive impact long after the divorce papers are signed.

Thinking Beyond a 50/50 Split

While a 50/50 division of the community property portion is the standard starting point in Texas, it’s not your only option. Through negotiation or mediation, you can propose an "asset tradeoff," where you keep more (or even all) of the 401k in exchange for giving up another asset of similar value.

For instance, let's say your ex-spouse's share of the 401k comes out to $100,000. You could offer them $100,000 in equity from the marital home instead. This can be a brilliant strategy if you're determined to keep your retirement savings intact and want to avoid the hassle of the QDRO process.

This kind of trade-off has real advantages:

- Keeps Your Retirement Plan Whole: You avoid having to liquidate investments, which could disrupt your long-term growth strategy.

- Provides Immediate Cash for Your Ex-Spouse: They might prefer a lump sum from a home sale over funds they can't touch for years.

- Simplifies the Process: You might be able to skip the QDRO entirely, saving everyone time and legal fees.

But be careful. A dollar in a pre-tax 401k is not the same as a dollar in home equity. You must consider the after-tax value of each asset, so always run these scenarios by a financial advisor to make sure the trade is truly fair.

Factoring in Market Volatility

Dividing a 401k when the market is volatile can feel like trying to hit a moving target. The account's value can swing wildly from the day you file for divorce to the day the division actually happens.

To protect yourself, avoid agreeing to a fixed dollar amount. Your divorce decree and QDRO should award a percentage of the account value as of a specific date—usually the date the funds are actually divided. This ensures both you and your ex-spouse share equally in any market gains or losses that happen along the way. It keeps the split fair, no matter what the stock market does.

Practical Advice: Don't let a temporary market downturn rush you into a bad deal. If your 401k is down significantly, it may be wise to negotiate based on percentages so both parties can benefit when the market eventually recovers.

Beyond the 401k, remember to think about shared tax liabilities from the marriage. It's worth looking into provisions like Innocent Spouse Relief, as it can be a critical tool for avoiding unexpected financial gut punches from old tax returns.

Common 401k Division Mistakes and How to Avoid Them

Even with the best intentions, costly errors happen all the time. Being aware of these common pitfalls is the first step toward avoiding them. Here is a quick rundown of mistakes we frequently see and how you can steer clear of them.

| Common Mistake | Potential Consequence | How to Avoid It |

|---|---|---|

| Using Vague Language in the QDRO | The plan administrator rejects the order, causing long delays and forcing you to pay more legal fees to fix it. | Make sure your attorney uses precise language that meets the 401k plan's specific rules. Ask them to get a pre-approval from the plan administrator if possible. |

| Forgetting to Update Beneficiaries | Your ex-spouse could unintentionally inherit your entire 401k if you pass away, even years after the divorce is final. | The day your divorce is finalized, contact your plan administrator to update your beneficiary designation forms. Do not wait. |

| Ignoring Tax Implications | You agree to an asset swap that looks fair on paper but leaves you with a much larger tax bill down the road. | Work with a CPA or financial advisor to analyze the after-tax value of all assets before you agree to a final settlement. |

| Failing to Follow Through | The divorce is final, but nobody ever submits the QDRO to the court or sends the approved order to the plan administrator. | Stay proactive. Follow up with your attorney to confirm the QDRO has been signed by the judge and formally accepted by the plan. |

Negotiating the division of your 401k isn't just about numbers; it requires a strategic game plan. By considering creative solutions and learning from the mistakes of others, you can walk into your settlement talks from a position of strength and confidence.

Navigating a Gray Divorce and Its Impact on Retirement

Ending a marriage later in life hits differently, especially when you’re looking at a retirement you thought you’d be sharing with someone. If you're over 50, a divorce doesn't just disrupt your present—it can completely upend the financial security you've spent decades building. This situation, often called a "gray divorce," brings a unique and harsher set of financial hurdles.

The core problem is time. When you split up in your 30s, you have decades to rebuild your savings. But when you’re dividing a 401k in your late 50s, that runway is gone. You’re suddenly forced to split a nest egg right before you need it most, with very little time to make up the shortfall.

The Financial Realities of a Later-in-Life Split

If it feels like more people are divorcing later in life, you’re not imagining it. Divorces among Americans over 50 have more than doubled since 1990. The financial fallout is often brutal: wealth typically plummets by around 50% after a gray divorce, and incomes can collapse even more, particularly for women. You can read more about these financial impacts in 401k Specialist Magazine.

This financial shockwave hits so hard for a few key reasons:

- Less Time to Recover: You simply have fewer working years left to replenish a divided 401k.

- Higher Healthcare Costs: As you get older, healthcare becomes a much bigger expense. Now, you may be on the hook for your own insurance premiums that were once covered by a spouse's plan.

- Loss of a Dual Income: You're moving from a two-income household to a single one at what is often the most expensive stage of your life.

The Role of Social Security in Long-Term Marriages

For couples who were married for 10 years or longer, Social Security benefits can be a critical financial cushion. This is an often-overlooked but vital piece of the retirement puzzle in a gray divorce.

If your marriage lasted at least a decade, you may be entitled to claim Social Security benefits based on your ex-spouse's work record.

Practical Advice: Your claim does not reduce your ex-spouse's Social Security benefits in any way. It's a provision specifically designed to support individuals who may have earned less during their careers, often because they were raising a family or supporting their spouse's career.

To qualify, you generally need to be at least 62 years old, unmarried, and your own benefit must be less than the spousal benefit you'd receive. Understanding these rules can make a huge difference in your long-term financial plan and provide an income stream you might not have known you had.

Meticulous Financial Planning is Non-Negotiable

When you're going through a gray divorce, there is no room for error. The stakes are just too high. Every decision about dividing your 401k, the house, and other assets must be made with a laser focus on your long-term financial independence. This isn't just about getting a "fair" settlement; it's about structuring that settlement so it can last you for the rest of your life. This demands a strategic, forward-thinking approach. Partnering with a legal team that truly understands the unique pressures of a gray divorce isn't a luxury—it's a necessity to protect the future you worked so hard to build.

Key Takeaway: Your Action Plan for Protecting Your Retirement

Feeling overwhelmed is completely normal when you’re facing a divorce. But you can get back in the driver's seat by focusing on a few clear, immediate steps. This is your practical roadmap for what to do right now to protect the retirement you’ve worked so hard for.

What to Do Next

- Gather Your Documents: Your first move is to get organized. Start gathering every financial document you can find related to your retirement accounts, especially the statement closest to your date of marriage. This piece of paper is the bedrock for proving your separate property claim.

- Contact Your Plan Administrator: Get in touch with your 401k plan administrator. You don’t need to tell them you’re getting divorced yet, but you should ask for a copy of their official procedures for divorce and QDROs. Every plan has unique rules, and getting this information early will save you headaches later.

- Consult with Professionals: The single best investment you can make right now is in professional advice. An experienced Texas family law attorney can review your situation and build a strategy to protect your assets from day one, while a financial advisor can help you understand the long-term impact of any settlement offer.

- Remember Beneficiaries: As part of your game plan, remember that updating the beneficiary designations for all your retirement accounts after the divorce is finalized is absolutely critical. It's essential to understand the importance of beneficiary designation forms to make sure your assets go to the right people.

This process is a marathon, not a sprint, but you don't have to run it alone. Our goal is to leave you feeling educated, empowered, and ready to move forward with confidence. The choices you make now will echo for decades, and getting clear, compassionate guidance is the key to securing your financial future.

We invite you to schedule a free, no-obligation consultation with The Law Office of Bryan Fagan, PLLC. Let us listen to your story, answer your questions, and provide the clarity you need to protect what you've earned.

Frequently Asked Questions About Dividing a 401k in Texas

When you're facing the reality of splitting up a 401k, many questions and worries naturally come to the surface. Below are clear, direct answers to the questions we hear most often from our clients in Texas.

Can I stop my spouse from getting my 401k?

In Texas, you generally can't block your spouse from getting their share of the community property part of your 401k. The Texas Family Code is clear: assets built up during the marriage must be divided in a "just and right" manner.

However, you can and should protect your separate property—the money you had in the account before you got married. Beyond that, you can get creative in negotiations. Many people choose to trade other community assets, like the equity in the family home, to keep more of their retirement savings in their own name. This is a common strategy in mediation.

What happens if we split a 401k without a QDRO?

Trying to divide a 401k without a Qualified Domestic Relations Order (QDRO) is one of the biggest financial mistakes you can make in a divorce. Your plan administrator will not recognize your divorce decree as a valid instruction to split the account. They legally can't.

If you decide to just withdraw the money yourself and hand it over to your ex-spouse, the IRS will see that as an early distribution. That means you'll be on the hook for income taxes and a 10% penalty on the entire amount withdrawn. A QDRO is the only legal instrument that allows for a penalty-free transfer, ensuring the asset's value is protected for both of you.

How long does the QDRO process take in Texas?

The timeline for a QDRO can vary. The order itself can be drafted while your divorce is still ongoing or after it's been finalized. Once a Texas family court judge signs it, the QDRO is sent to your 401k plan administrator for their internal review.

This review process can take anywhere from a few weeks to several months, depending on the plan's complexity and the administrator's current workload. It's always best to get this process started as early as possible to avoid frustrating delays in finalizing your property division.

You've worked hard to build your future, and our priority is to help you protect it. At The Law Office of Bryan Fagan, PLLC, we guide Texas families through the complexities of dividing a 401k in divorce with compassion and strategic legal advice. Schedule a free, no-obligation consultation today to get the clarity and support you deserve. Contact us at https://texasdivorcelawyer.us to take the first step.