That nagging sense that the financial story you’re being told just doesn’t add up can be one of the most stressful parts of a divorce. If you're worried your spouse is hiding assets, you are not alone, and your suspicions deserve to be taken seriously. Uncovering the complete financial picture isn't about getting even; it's about securing the fair and just settlement you are legally entitled to under Texas law so you can move forward with confidence.

Understanding Hidden Assets in a Texas Divorce

That instinct you feel—the sense that something is financially off—is often the first signal that you need to dig deeper. In a Texas divorce, the law demands full transparency. According to the Texas Family Code, everything acquired from the day you got married until the day you divorce is presumed to be community property, belonging equally to both of you. Hiding assets is a direct attempt to manipulate that division unfairly.

What Are Hidden Assets?

Hidden assets aren't always bags of cash buried in the backyard. The deception can range from simple omissions on a financial statement to incredibly complex schemes designed to make money disappear. Your spouse might be intentionally concealing property that absolutely should be part of the marital estate and subject to a "just and right" division.

Some of the more common tactics include:

- Secret bank or investment accounts opened without your knowledge.

- Unreported income, especially cash from a side business that never makes it to the books.

- Valuable property, like art or collectibles, that are suddenly "gifted" to friends or family with the understanding they'll be returned after the divorce.

- Deferred compensation, stock options, or bonuses that are conveniently delayed until after the divorce is final.

No matter the method, the goal is always the same: to make the marital estate look smaller than it really is, leaving you with less than your fair share. This act of intentionally hiding or squandering assets is a serious offense in the eyes of a Texas court.

Why Uncovering Assets Is Critical for Business Owners and High-Net-Worth Individuals

In high-net-worth divorces, the schemes can get much more sophisticated. Offshore accounts remain a popular method, using foreign banking jurisdictions with strict confidentiality laws to create privacy. We've also seen trusts and shell companies used to obscure who really owns an asset, making the division process a nightmare for the uninformed spouse.

This issue is more widespread than people think; some studies show that nearly 39% of U.S. adults with combined finances admit to withholding financial information from their partners. You can find more details about how spouses conceal wealth in our in-depth guide on the subject.

A judge in Texas has the authority to award a disproportionate share of the community estate to you if they find your spouse committed fraud on the community by hiding assets. Your fight for transparency is backed by the law.

Ultimately, bringing these assets into the light ensures that the property division is based on the true value of your shared estate. It allows the judge to make a "just and right" division, as required by the Texas Family Code, giving you the resources you need to begin your next chapter on solid ground.

Recognizing the Red Flags of Concealed Assets

Trusting your gut is a powerful first step, but in court, you need more than a feeling—you need evidence. The reality is that a spouse who intends to hide assets usually starts laying the groundwork long before divorce papers are ever filed, often through subtle but significant shifts in their behavior and financial habits.

When you've built a life and shared finances with someone, you know their patterns. A sudden, unexplained break from that baseline is almost always the first sign that something is wrong. A spouse who was once an open book about your joint finances might suddenly get defensive or secretive when you ask about a bank statement or a large purchase.

Behavioral and Financial Warning Signs

These changes aren't just about money; they can feel deeply personal and hurtful. Your spouse might start hovering over the mailbox, insisting on getting the mail first, or even open a new P.O. box without a good reason. It’s a classic tactic to intercept new bank or credit card statements they don't want you to see.

Keep a close eye on these common indicators:

- Sudden Financial Secrecy: Passwords on computers and financial apps are changed without warning. You're suddenly locked out of online accounts you’ve always shared.

- Unexplained Cash Withdrawals: You notice large sums of cash being taken from joint accounts, but the explanation for where it went is vague or just doesn't add up.

- Changes in Mail Delivery: Financial statements that used to arrive at your home are now being sent to their office or a new, undisclosed P.O. box.

- "Gifts" to Family or Friends: Your spouse might "loan" or "gift" significant amounts of money or valuable items to a trusted friend or relative. The unspoken agreement is that these assets will be returned after the divorce is final.

- A Business Reporting Sudden Losses: If your spouse owns a business that has always been profitable but is now mysteriously in the red, it could be a sign of cooked books. They might be deferring income or prepaying imaginary expenses to drive down the business's value on paper.

This kind of behavior often goes hand-in-hand with other signs that the marriage is in trouble. If these financial red flags are popping up, it's a good idea to also review other potential signs your spouse is planning to file for divorce to get a clearer picture of the situation.

Where Spouses Commonly Hide Assets

| Asset Category | Common Hiding Tactics |

|---|---|

| Cash & Bank Accounts | Opening undisclosed bank accounts, storing cash in a safe deposit box, or making frequent, large ATM withdrawals. |

| Business-Related | Deferring salary or bonuses, overpaying taxes (for a refund post-divorce), creating phony expenses, or paying "ghost" employees. |

| Investments | Transferring stocks to a friend/family member, purchasing cryptocurrency, or buying collectibles like art or jewelry that are easy to undervalue. |

| Real Estate & Property | Transferring property titles to a shell company or relative, or intentionally undervaluing real estate assets during appraisals. |

| Digital & Online | Using online payment platforms like PayPal or Venmo to hold funds, or investing in hard-to-trace digital assets and NFTs. |

Knowing where to look is half the battle. These categories cover the most frequent schemes we see, but a determined spouse can get creative. The key is to look for deviations from normal financial behavior.

Digital Clues in a Modern Divorce

In today's world, hiding assets almost always leaves a digital footprint. Your spouse might become intensely private about their phone or computer, meticulously clearing their browser history or only using incognito mode for financial activities. You might even spot new financial or cryptocurrency apps on their phone that you've never discussed.

In Texas, a spouse has a fiduciary duty to the community estate. This means they have a legal obligation to manage community property responsibly and in good faith. Intentionally hiding assets is a direct breach of this duty.

For example, imagine your spouse’s business has been thriving for years. As you start discussing separation, they suddenly claim they’re on the verge of bankruptcy. But their lifestyle hasn't changed a bit—they’re still taking expensive trips and buying luxury items. This glaring mismatch between their reported income and actual lifestyle is a massive red flag that demands a closer look.

If these patterns sound familiar, it's critical that you don't confront your spouse directly. A confrontation will only tip them off, causing them to cover their tracks even more carefully. Instead, your first move should be to discreetly start gathering any financial documents you can legally and safely access and then speak to an experienced divorce attorney.

The Texas Divorce Process: Using Legal Tools to Uncover Financial Truth

That sinking feeling in your gut is one thing, but proving your spouse is hiding assets requires cold, hard facts. This is where the Texas legal system becomes your greatest ally. It gives you a structured and powerful process to demand financial transparency and finally get the answers you deserve. You don't have to rely on guesswork or snooping—the law is on your side.

Step-by-Step: The Discovery Phase

From the moment you file your Original Petition for Divorce, a legal process called discovery begins. Think of it as a set of legal tools your attorney uses to legally require your spouse and third parties (like banks or business partners) to hand over information. It’s not about slinging accusations; it’s about collecting the puzzle pieces needed to see the full financial picture.

Here are the primary tools we use to get to the bottom of things:

- Interrogatories: These are written questions sent to your spouse that they must answer in writing, under oath. We can ask pointed questions like, "List every bank account, domestic or foreign, in which you have had a financial interest since January 1, 2020."

- Requests for Production: This is a formal demand for documents. Your attorney can request years of bank statements, credit card bills, tax returns, business profit-and-loss statements, loan applications, and brokerage account records.

- Requests for Admission: These are strategic yes-or-no questions designed to lock your spouse into a specific statement. For example, "Admit that you transferred $50,000 to your brother in May of last year." A denial opens the door for us to prove they are lying.

- Depositions: This is a formal interview where your attorney questions your spouse (or another relevant witness) under oath in front of a court reporter. It’s a powerful way to get real-time answers, follow up on inconsistencies, and observe their demeanor.

These tools work together to create a comprehensive web of information. A suspicious transaction found on a bank statement (from a Request for Production) can become the basis for a direct question in a deposition.

The Sworn Inventory and Appraisement

One of the most crucial documents in any Texas divorce is the Sworn Inventory and Appraisement. Under the Texas Family Code, both you and your spouse are required to complete this form, listing every single asset and debt you know of—both community and separate property—along with your estimated value for each.

This isn't just another form. You sign it under penalty of perjury. Knowingly omitting an asset or lying about its value on the Sworn Inventory is the legal equivalent of lying to the judge in open court.

If your spouse "forgets" to list a secret investment account, and we later uncover it through discovery, their credibility is destroyed. Judges do not look kindly on this kind of deception.

This fraudulent behavior can have severe consequences, including the judge awarding a disproportionate share of the entire community estate to you as a penalty. Hiding assets is a direct violation of their duty to the marriage, and Texas law provides a remedy for that breach of trust. In some situations, this behavior is classified as dissipation of assets, a serious matter. You can learn more about how to prove dissipation of assets in a Texas divorce case in our detailed guide.

The discovery process can feel intimidating, but it is your legal right. It levels the playing field and replaces suspicion with solid evidence, moving you one step closer to mediation or a final decree.

When You Need a Financial Detective on Your Team

Sometimes, the paper trail your spouse leaves behind is so tangled and intentionally confusing that the usual legal tools just won't cut it. You get documents through discovery, but instead of answers, you're left with even more questions. When the numbers simply don't add up, it’s a strong sign you need to bring in an expert.

This is where a forensic accountant becomes one of the most valuable players on your divorce team.

Think of them as a financial detective. Their entire job is to dig deeper than bank statements and tax returns. These professionals are trained to find the real story behind the numbers—tracing convoluted transactions, spotting irregularities in business records, and putting an accurate value on complex assets like a family business or stock options.

Bringing in an expert isn't a sign of weakness. It's a strategic move to level the playing field, especially if your spouse was the one managing all the finances during the marriage. It’s about ensuring every single dollar is accounted for so the final property division is genuinely fair.

Clear Signals You Need a Forensic Accountant

While a good divorce lawyer can uncover quite a bit during the discovery process, some situations practically scream for a financial specialist. Hidden assets can completely distort the true financial picture of a marriage, and if you don't find them, you can't get your fair share.

You should seriously consider hiring a forensic accountant if your divorce involves any of these red flags:

- Your Spouse Owns a Business: This is the number one reason to call in an expert. A business offers endless ways to hide money, from paying "employees" who don't exist to overpaying vendors for a kickback on the side. They can also write off personal expenses as business costs, artificially lowering the profits on paper.

- A Sudden, Drastic Drop in Reported Income: If your spouse’s income or business profits suddenly plummet the moment divorce is on the table—yet their lifestyle hasn't changed a bit—something is off. A forensic accountant can investigate whether income is being deferred or funneled elsewhere.

- Complex or High-Value Assets: Putting a number on assets like stock options, pensions, intricate investment portfolios, or professional practices isn't simple guesswork. An expert ensures these are valued correctly, not based on your spouse's convenient lowball estimate.

- Suspected Offshore Accounts or Cryptocurrency: Tracing money that’s been moved to foreign banks or converted into digital currencies like Bitcoin takes a high level of technical skill. Forensic accountants often have the experience needed to follow these digital and international money trails.

- A Lifestyle That Doesn't Match the Paycheck: Does your spouse claim to make $100,000 a year but somehow manages to afford luxury cars, frequent international trips, and expensive hobbies? An expert can perform a lifestyle analysis to demonstrate to the court that there has to be another source of income.

What Does a Forensic Accountant Actually Do?

Once they’re on your team, a forensic accountant works hand-in-hand with your attorney. They don't just find the hidden assets; they provide the concrete proof and expert testimony you need to make your case stick, whether you're in mediation or in front of a judge.

Here's what their work typically involves:

- Tracing Funds: They follow the money. If a big chunk of cash disappeared from a joint account, they’ll trace exactly where it went—whether to a secret account, a friend's business, or a hidden investment.

- Business Valuation: They’ll analyze a business’s true worth by digging into its books, cash flow, assets, and goodwill. This prevents the business from being deliberately undervalued for the divorce settlement.

- Analyzing Financial Records: They comb through years of financial data, looking for patterns, red flags, and inconsistencies that a layperson (and even many lawyers) would easily miss.

- Creating an Expert Report: All their findings are compiled into a formal, detailed report that can be used as powerful evidence during negotiations or at trial.

- Providing Expert Testimony: If your case goes to court, the forensic accountant can testify as an expert witness. They are skilled at explaining complex financial matters to a judge in a way that is clear, credible, and compelling.

Engaging a financial expert sends a clear message to your spouse and their attorney: you are serious about uncovering the complete financial truth and will not accept a settlement based on incomplete or false information.

While a forensic accountant is an added expense, the value they uncover often far outweighs their fee. Finding a single hidden $100,000 investment account can completely change the outcome of your property division. Sometimes, their skills are best paired with other professionals. For a different angle on investigations, you can learn more about the role of private investigators in Texas divorce cases in our other guide.

If you have a gut feeling that your spouse is hiding assets in a complex financial web, the very first step is to talk to your attorney. We can help you decide if hiring a forensic accountant is the right move for your specific situation and connect you with trusted, reputable professionals we’ve worked with before.

Finding Modern Assets in a Digital World

Wealth isn't just stored in bank vaults anymore. Today, it can be completely invisible, existing only as data on a server or a transaction on a blockchain. If you suspect your spouse is using modern financial tools to hide assets, you’re facing a sophisticated challenge. But don't feel overwhelmed.

Even the most complex digital assets leave a trail. Uncovering them is less about being a tech wizard and more about knowing where to look and who to bring in for help. The methods for hiding wealth have evolved, but so have the methods for finding it. Your legal team, often paired with financial experts, can follow these digital breadcrumbs to make sure every penny is accounted for.

The Rise of Cryptocurrency and Digital Wallets

Cryptocurrencies like Bitcoin and Ethereum present a unique hurdle in divorce cases. They’re decentralized—no single bank controls them—and transactions are pseudonymous. It's a common tactic for a spouse to transfer marital funds to a crypto exchange, buy digital currency, and then move it to a private digital wallet that has no obvious connection to their name.

But "anonymous" doesn't mean untraceable. Every single transaction is permanently recorded on a public ledger called the blockchain. A forensic expert can analyze this ledger to trace the flow of funds, often starting from a known bank account, moving to an exchange, and then hopping between various digital wallets. It’s meticulous work, but it frequently reveals a clear pattern of someone trying to move money out of reach.

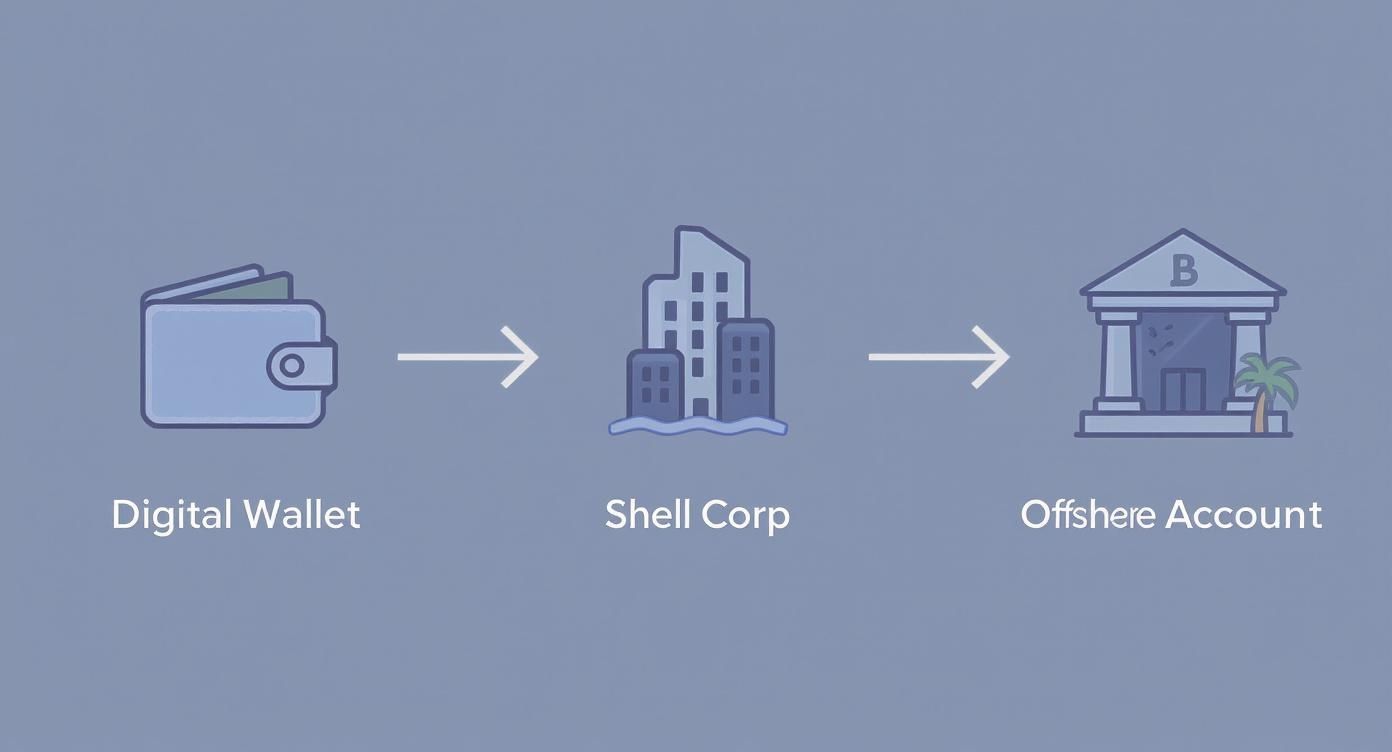

Untangling Shell Corporations and Offshore Accounts

Another popular strategy is creating layers of ownership to obscure who really controls an asset. Your spouse might set up a shell corporation—a company that exists only on paper—and use it to open a bank account, often in an offshore location known for its strict banking privacy laws. Funds from your community estate can then be funneled into this corporate account, disguised as a legitimate business expense.

This is where the formal discovery process becomes so powerful. Your attorney can subpoena records not just from your spouse, but from their business, their partners, and any financial institutions involved. We can unravel these complex structures by demanding operating agreements, bank records, and communications that show the true purpose and ownership of these entities.

The case of Lisa Martinez is a stark reminder of how sophisticated these schemes can get. She discovered her husband had hidden $320,000 in cryptocurrency, a significant stake in a real estate venture, and an offshore account in the Cayman Islands. As detailed in this breakdown of a $1.2 million divorce mistake, uncovering these modern assets required deep forensic expertise.

A Real-World Scenario: Piecing the Puzzle Together

Imagine this: you notice large, unexplained wire transfers from your joint account to an LLC you've never heard of. Your spouse dismisses it as a "business investment."

Your legal team gets to work. First, we request all formation documents for that LLC and discover it's registered to your spouse's cousin with no real business operations. Next, we subpoena the LLC's bank records. We find the money was immediately wired to a foreign bank account in a country with tough privacy laws.

At the same time, we analyze your spouse's computer and find traces of logins to a cryptocurrency exchange. A forensic expert then traces transactions from that exchange to a series of private digital wallets. Suddenly, the pieces connect: community funds were moved to a shell company, wired offshore, and then likely used to buy cryptocurrency—all in an attempt to hide it from the marital estate.

In Texas, a spouse cannot simply give away or hide community property to cheat the other spouse out of their fair share. This is considered a "fraud on the community," and a judge can penalize the offending spouse by awarding a larger portion of the estate to you.

This puzzle may seem impossibly complex, but each piece of evidence we gather strengthens your case and exposes the deception. For a broad look at uncovering these types of clues, the ultimate guide to checking and managing your online presence can reveal overlooked digital trails.

No matter how advanced the hiding technique, a strategic legal approach combined with financial expertise can bring these assets back into the light, ensuring they are properly included in your property division.

Answering Your Questions About Hidden Assets

When you suspect a spouse is playing games with your finances, it's natural to have a lot of questions. We hear these concerns from clients all the time. Let's clear up a few of the most common ones so you know what to expect.

What Happens if My Spouse Gets Caught Hiding Assets in Our Divorce?

Texas courts have zero patience for financial deception. Intentionally hiding assets isn't just frowned upon; it's considered a "fraud on the community," which is a serious breach of trust.

A judge has the power to punish the dishonest spouse. Under the Texas Family Code, they can award a disproportionate share of the community estate to you. In plain English, that means you could walk away with more than 50% of the marital property to make up for their fraudulent behavior.

How Much Does It Cost to Hire a Forensic Accountant?

There's no single price tag, but you can generally expect to pay somewhere between $300 to $600 per hour. The final cost really depends on their experience and just how deep the rabbit hole goes in your case.

I know that sounds like a lot, but you have to think of it as an investment. Uncovering just one hidden account or proving a business was deliberately undervalued can swing the final property division by tens or even hundreds of thousands of dollars. More often than not, the return on that investment is well worth it.

Can the Court Make My Spouse Pay for the Search?

Absolutely. If your spouse’s dishonesty forced you to spend money finding what they hid, your attorney can ask the court to make them foot the bill. It's a matter of fairness.

A judge can order your spouse to pay for the legal and expert fees you racked up during the search. They might order them to reimburse you from their share of the estate or even award you additional assets to cover the costs you were forced to incur just to get to the truth.

What to Do Next: Your Path to a Fair Settlement

It’s completely normal to feel overwhelmed by the possibility that your spouse is hiding assets. But now, you’re armed with the knowledge to protect your financial future. Moving forward isn’t about dragging out a fight; it’s about ensuring you receive the just and right property division you're entitled to under Texas law.

Your Action Plan

- Trust your gut when something feels off and discreetly gather any financial documents you can legally access.

- Understand the legal process. The discovery phase is your opportunity to formally request information and get answers under oath.

- Build your professional team. Don't go it alone. A seasoned divorce attorney, and if necessary, a forensic accountant, can level the playing field and ensure no stone is left unturned.

As you can see, funds can be routed through multiple entities to hide their origin. To get to a truly equitable split, you have to understand fair market value for every single piece of property—both the assets disclosed willingly and those you've had to uncover.

Uncovering hidden assets is not about revenge. It is about securing the resources you need to begin your next chapter with the financial stability you rightfully deserve.

The single most powerful step you can take right now is to get personalized legal advice. You don’t have to face this challenge by yourself. Your future is far too important to leave to chance.

The experienced, compassionate team at The Law Office of Bryan Fagan, PLLC is here to give you the clear answers and strategic guidance you need. We help Texas families navigate divorce with empathy and confidence. Schedule your free consultation today and let us help you protect your rights and secure your financial future.